How the British Government's Attempts to Fight Corruption and Money Laundering are Already Failing

On 19 August 2017, Bellingcat published an article regarding the new Persons of Significant Control (“PSC”) requirements introduced by the government, intended to deter the owners of Scottish Limited Partnerships (“SLPs”) from using the vehicle’s unique opaque structure as a means to conduct criminal activity. Subsequently, as reported by the Guardian and the OCCRP, SLPs were used to launder the proceeds of another multi-billion money laundering scandal, this time the Azerbaijani Laundromat, hot on the heels of numerous stories revolving around SLPs and their widespread use by money launderers and fraudsters all around the world.

Now that the deadline has long-passed for SLPs to reveal who their PSCs are, Bellingcat have taken a second look at the PSC filings, to ascertain whether the government’s initiative has proven to be effective and what kind of information is being submitted to Companies House.

For the purposes of this article, all of the SLPs incorporated from 1 January 2016 to 31 October 2017 were examined and their PSC filings as of 8 November 2017 were recorded. During this time period, 7,827 SLPs were incorporated. Of these, 7,213 are still active. 2,402 (33%) have still not filed their PSC statement. 2,158 (30%) have named an individual or corporate vehicle as their PSC. The remainder have filed a variety of statements explaining why they cannot currently name their PSC, or statements claiming that there is no registrable person.

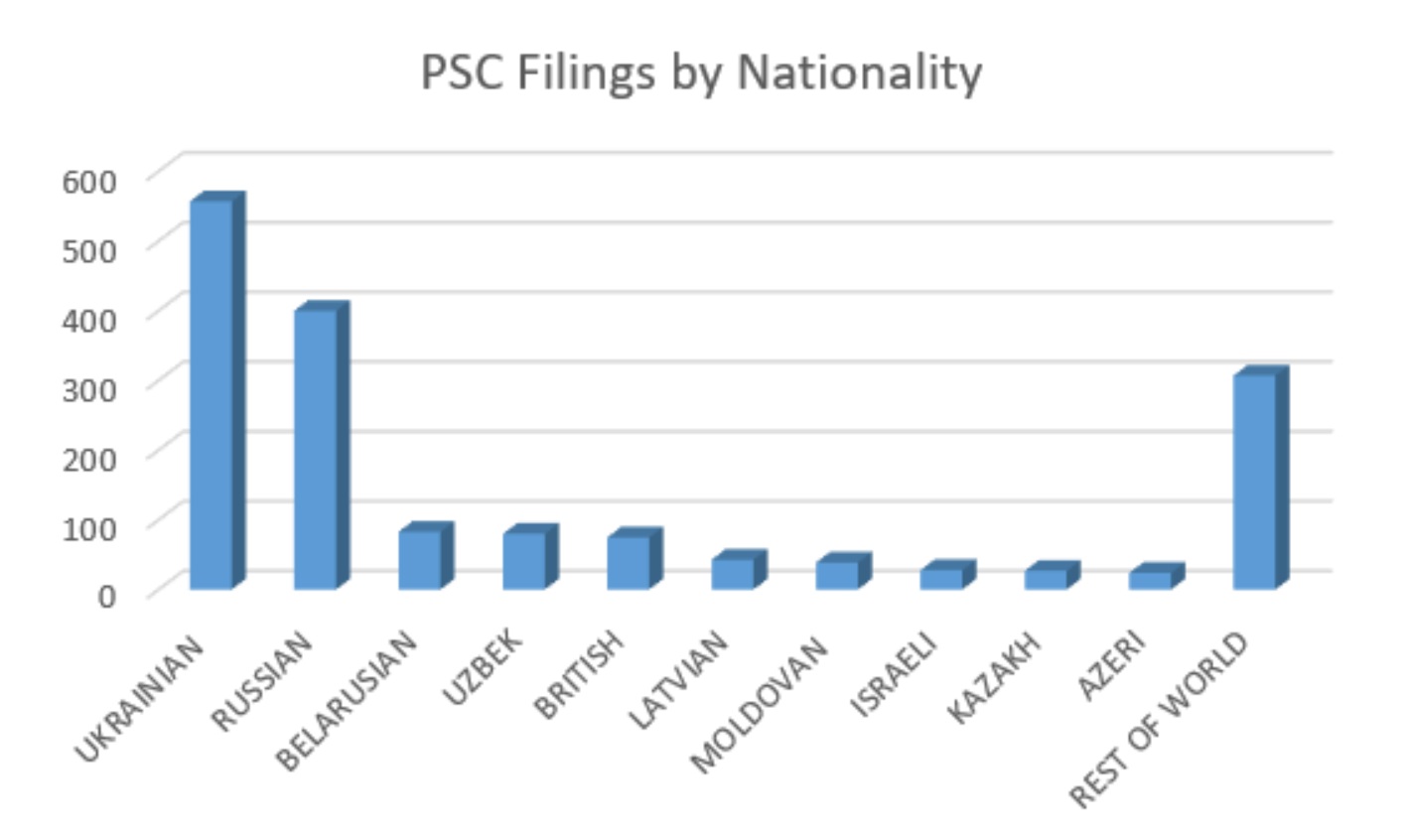

In the PSC statements so far filed, individuals from 62 countries are named. Notably, individuals in all of the post-Soviet states have been named and every continent in the world (excluding Antarctica) is represented. As stated in our previous report, British citizens are not named on the majority of PSC filings, falling behind Ukrainian, Russian, Belarusian and Uzbek nationals.

In fact, just 75 PSC filings name British nationals. In contrast, 557 Ukrainians are named on PSC documents and 400 Russians. But individuals only make up part of the picture, as 604 SLPs during the period have only named corporate vehicles as their PSC.

As you may expect, some the corporations in question come from all over the world, including well established offshore havens such as Belize, the Seychelles and St Kitts & Nevis. But, perhaps most surprising are the numbers of Scottish Limited Partnerships that are named as PSCs for other Scottish Limited Partnerships. SLPs are the most widely used corporate vehicle in PSC statements (with 229 SLPs incorporated during the period controlled by them).

For example, Primecar Universal L.P. is an SLP incorporated on 16 December 2016. The people who presented the incorporation documents chose to keep their contact details to themselves (as is the case with 1,292 SLPs incorporated in 2016), and their partners are Vectorex Inc. and Geotrans Inc., two Dominican based entities who have made periodic appearances in the Scottish Herald due to their attachment to SLPs involved in corporate ID theft and suspect transactions with the Georgian National Tourist Administration.

Primecar are currently the PSC for 19 SLPs, but their own PSC statement (which contains no contact information, just an illegible signature) claims that there is no registrable person who can be called a person of significant control. Indeed, almost all of the 229 SLPs acting as PSCs have partners based in offshore jurisdictions and have not named their own PSC. Companies House are currently not required to perform anti-money laundering due diligence checks on the people or organisations named on filings. Given the continuous exploitation of SLPs to conduct criminal activity this might seem like a basic and pro-active measure, instead of waiting for the next, inevitable, money laundering scandal to materialize.

As detailed in Bellingcat’s previous article on SLPs, the government introduced the Register of People with Significant control on 26 June 2017. The introduction of a PSC register was intended to compel SLPs to reveal who their true beneficial owners were and penalise those who chose not to, threatening a fine of up to £500 per day. This, so far, has proven to be an empty threat.

On 24 October 2017, Dame Margaret Hodge MP wrote to Margot James MP, the minister for small business, consumer protection and corporate social responsibility and asked how many SLPs had been fined since the PSC register came into force. The answer? Zero.

Even if you discount the SLPs who have filed their PSC statements months after the deadline, or those SLPs who have filed PSC statements designed to further conceal the identities of their true owners, there are still 2,402 SLPs registered since 1 January 2016 that have never filed a PSC statement of any kind. The deadline to file PSC statements was 24 July 2017, meaning that the government can legitimately claim in excess of £127million in late filing penalties.

Of course, the chances of recovering a fraction of this money are highly unlikely. The government has never specified who will pay these fines or how they will be collected. The controlling partners of these SLPs are commonly offshore companies who have no obligation to cooperate with UK authorities. The UK based formation agents who set up SLPs are not obliged to file documents or pay fines on behalf of their clients.

And what of the partnerships who have named individuals in their PSC statements? The majority are in jurisdictions far from the reach of UK authorities. It is hard to imagine what use hundreds of partnerships with no obligation to pay tax in the UK, partners in the Seychelles and PSCs in the former Soviet Union are to the UK economy. The PSC register was intended to create transparency and accountability. At best, it is a minor inconvenience for those who wish to abuse the system.